Introduction

The Chief Financial Officer is a valuable and, in most cases, indispensable position for the majority of companies today. The key role of a CFO includes cash flow management, improving financial strength, and indulging in the company's end-to-end financial planning. It is a great relief for the company executives to have a competent CFO on their roster. So understandably, the cost to the company of a CFO is relatively high. This discourages many companies, especially SMEs and startups, from hiring CFOs. This is where Virtual CFO comes into the picture.

What is a Virtual CFO

A virtual CFO is an individual or sometimes a firm of professionals who handles all the duties of a traditional CFO or specifically assigned tasks by the company working remotely and usually part-time. The position of virtual CFO was created, seeing the sharp rise in new, smaller businesses in the last decade. These are firms that are on the fence with regard to financial help. They need a professional who can guide them properly but aren't ready for the expenses or the commitment. Modern technology is also an irreplaceable facility for VCFOs. They work primarily through calls and video conferences and complete their tasks remotely with the same proficiency as a full-time CFO. This is thanks to the latest cloud-based solutions for accounting and finances.

Services Offered

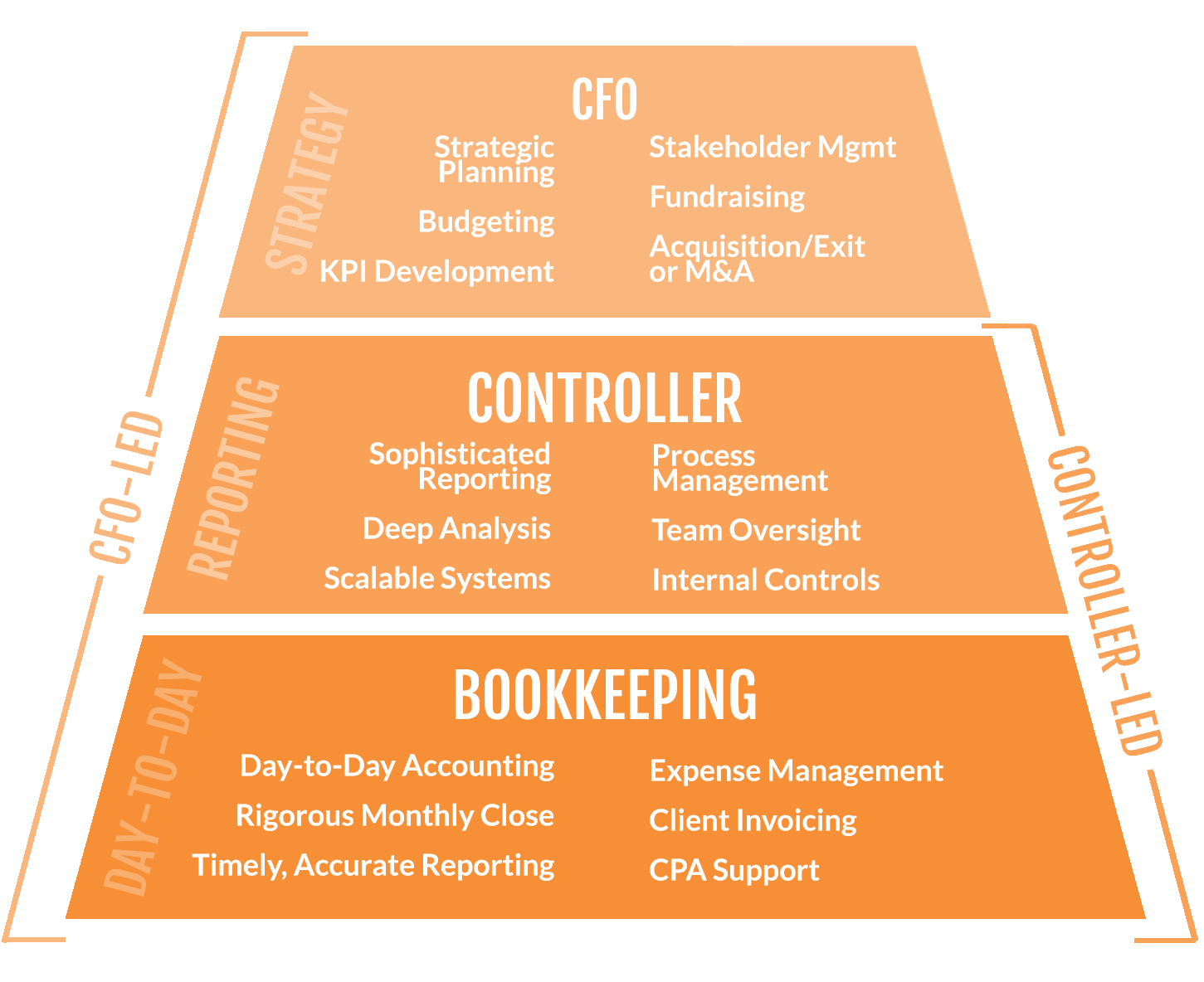

A virtual CFO offers all the perks of an in-house CFO while eliminating all of the downsides. Their primary job is to monitor and maintain the financial wellbeing of the company. This requires- compliance and accounting , financial planning, cost management, finance process reviews, estimating a budget, preparing a financial statement, risk management, offering financial insight and advice, etc.

To be more specific, a CFO's crucial tasks would be-

- Modelling cash flow and regularly updating and implementing cash flow forecasting

- Identifying opportunities and analyzing them

- Capital investment analysis and due diligence Reviewing supply chain and finance processes and suggesting ways to economize

- Drafting a suitable budget for the coming fiscal year

- Preparing a financial report for the prior fiscal year

- Cost-benefit analysis and contingency planning

- Working with the bookkeepers and supervising accounting

- Plotting a growth chart for the company and implementing it

- Taking care of any snags or unforeseen issues in the finances of the firm

It is apparent that a CFO brings a lot to the table, and hiring one is an excellent decision in the long run. The latest online accounting software, like Finalyzer and SmartRecon, makes Virtual CFOs' jobs even more effortless and benefits the company. Now that Work-from-home is the new normal, VCFOs are more relevant than ever before.

Benefits Over Traditional CFO

Virtual CFOs can do most of the tasks a regular CFO would do, like mentioned above. But the most significant advantage they have over traditional CFOs is their cost-effectiveness. Chief financial officer is a senior position and requires someone with credentials and experience. Naturally, it is a high-paying job and can make your budget bleed. Virtual CFO services offer similar help with a much lower price tag. That alone is enough of a reason to consider hiring them. But VCFOs have much more to offer.

1. No Commitment

A virtual CFO is generally a short-term, part-time employee. Depending on your contract, you could get a CFO who is low-maintenance, inexpensive and comes with no-strings-attached. This is an ideal professional relationship for a firm that is just taking off and requires some help managing its money. And if everything goes smoothly, you could always keep them with you on a long-term relationship basis as well.

2. Vast Experience

Since virtual CFOs work for different employers for a certain duration, they have the unique advantage of having multiple-sector experience. They can deal with various other kinds of issues and will be ready for anything thrown at them.

3. Customized Service

When you outsource financial support, you get to select precisely what services you require from the CFO. This means that you can choose only those tasks you need to do, and of course, only pay for those services. This adds to your savings and makes this choice that much more beneficial.

4. Smooth Starts and Hand-offs

Usually, new employees take some time to fit into the company and get to know their co-workers and the clients. CFOs go through the same learning curve. However, virtual CFOs are used to starting with new people and get up to speed much quicker. They can adapt to the new environment and get familiar and up to speed within the first few weeks of joining.

5. Support Team

If you are dealing with a business that offers virtual CFO services, then it is likely that you have one VCFO as a point of contact, and you are getting the services and expertise of an entire team of CFOs. This means that there are hardly any problems with the work, and you get the best that the CFO business offers.

6. A New Perspective

An outsourced CFO looks at problems from an outsider's point of view. Their thoughts on a subject of discussion can shed new light on it and could reveal valuable information that you would have otherwise missed. They are great at seeing the big picture and bring a fresh perspective.

Should you opt for a Virtual CFO

At this point, it's relatively apparent that virtual CFO services are an excellent solution for your financial worries. But how to decide if they are the right fit for your company? Generally, VCFOs are best for firms with a successful initial phase and are looking to grow to the next level. Usually, this would include businesses with revenues between $0.5 million and $25 million. There is no rule as such, though, that mandates these figures. If a virtual CFO suits your needs, you should look for one. Some signs that you should hire a virtual CFO service are:

- Your business is growing in magnitude rapidly. If this is an unprecedented spurt, your finances could be in a mess as the existing system wouldn't be equipped to handle the growing numbers.

- Your finances are in an adverse condition, and you cannot figure out a reason for it. This happens to many companies, and the insight of a financial expert is a probable remedy.

- No one in your team has the financial expertise or experience to guide your company through financial decisions and plan ahead regarding monetary affairs.

There are other indicators too, like being late at following compliances, diminishing profits, falling short of targets, and so on. Of course, hiring a virtual CFO is not the only solution, but it is quite a safe one.

Conclusion

Finances are an essential subject in any company. Whether you are with a small firm that is still maturing or a large corporation working with huge figures daily, you need, and hopefully already have, someone to oversee your financial activity. In most cases, that would be the CFO. With all the provisions of modern technology and having all these advantages over traditional CFOs, it is absurd to not give virtual CFO services a try. Besides, the global situation being, an in-house CFO will not seem very different from a virtual one, as both will be working from home. You can consult us for any queries regarding virtual CFO services. Give this article a look to know more about VCFOs and their relevance in the SME sector .

Visit KGMC India for more such insights!